I get up and wonder what future awaits me. I know it is determined by what I have been doing over past days and years. It is also shaped by what people around me (and afar from me) have been doing and expect of me. In a larger sense, forces of nature are also going to decide what my future is.

In the same vein, how do we reckon what future awaits a firm? Since the firm acts in a particular way, and so do its competing firms act in their own particular ways, and the entities of the entire social-economic crucible act in myriad ways, with all this happening under impact of actions of all facets in the nature’s realm; all this cumulative action is bound to create a future for the firm. Three posers arise: what percent of future of the firm would be firm’s direct creation? What percent of the future, howsoever created by firm’s direct actions or actions of other agents, be known reliably in advance? And to what extent the firm would be prepared to emerge a winner in whatever future that emerges?

This paper primarily tackles the third poser, enhancing a firm’s chances of emerging a winner, whatever the future it encounters.

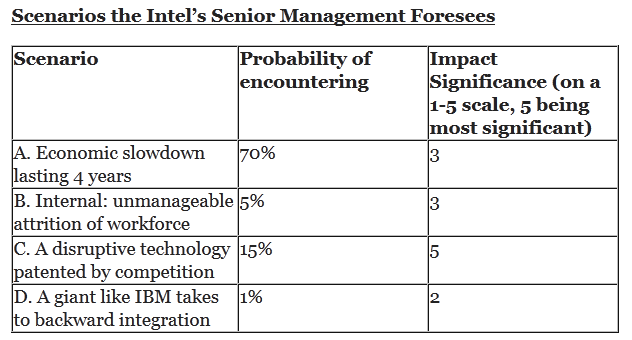

It is often presumed that chance favors the prepared mind. This implies a firm has a position of advantage if it can anticipate the future and get suitably prepared for that future. Performing firms invest resources in trying to map their future. This results in the firm chalking out multiple scenarios which are likely: Plan A, Plan B, Plan C et al. The firm may associate different probabilities with the occurrence of these scenarios. Alongside the firm imagines benefits and perils that may flow from these scenarios. The firm has to make efforts in being ready to capitalise these scenarios.

But then, like it or not, it is difficult to precisely predict the future. The next best thing to not being able to anticipate the precise future is to be prepared for everyone of the three-four scenarios that are likely to emerge. Yes, being prepared for the likely scenarios helps; but this too requires diverting valuable scarce resources towards studying these scenarios. And to be significantly prepared for any of these eventual scenarios itself demands stressing the firm’s valuable scenarios. This shall put demands on resources, but would place odds in favor of the firm, as the combined probabilities of the three-four scenarios shall cover the major possibilities.

However, at times, the actual future may be at departure from all of these three-four scenarios. What should now be done as handling an unanticipated future would be a real challenge as the firm has not prepared for this. Most consultants too have created a dread in the minds of firm leadership, that encountering an unanticipated future would be curtains for the firm. It is pronounced that if the firm is not proactive, it is on a death path. But is this situation so tricky after all?

It is not always such an alarming eventuality. In cricket, without knowing what ball the batsman would get, he still manages to wallop it to the boundary. He ably saves his wicket, and sometimes lops the ball for a six. In baseball, the moment the ball leaves the pitcher’s hand, the batter can respond whichsoever way he likes, and at times score a home run. In basketball, you can never for sure predict where the ball would go, yet we have sportsmen like Magic Johnson who scored an average of 32 points. In tennis, you can win by guessing in advance where the opponent would lop the ball; but your guess may be off-mark. In fact, if a tennis player walks into a part of the court as per her guess, she may find the ball is lopped where she can never reach. This is why, returning to the center axis of the court is advised as that position allows accessing all parts of the court. Uncertain future is what adds thrill to these games, and there is no resentment or angst at not knowing the future in advance. Genuine efforts are made to anticipate, nevertheless the players rely on quick reflexes. No reason a firm should not hone its reflexes and be only concerned about grooming its proactive capabilities.

Let us focus on what the authors call, the batsman’s “winning space”. The cricket batsman can be poised to grasp the overall scenario: what role is expected of him under the conditions and what is the general nature of the adversary team’s tactics alongwith its bowler’s. He can be sensitive to the pitching of last few balls. Now as he faces the current ball, he can try reading the bowler’s body and mind. But what is his ‘winning space’. When the ball has left the bowler’s hand, the batsman’s ‘winning space’ commences and the ball is entirely his for doing whatever he plans till he steers it whichever way or leaves it untouched.

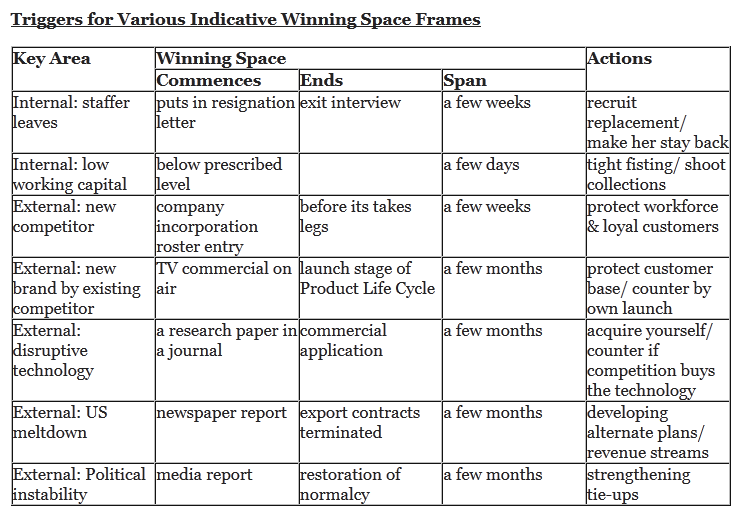

Similarly, every firm has the luxury of having a ‘winning space’, which is entirely its own turf. The trigger for this can be your reading in morning newspaper of a competitor’s new product launch, his diversification plan, his retrenchment drive, his tying up with a globally leading customer or vendor or any business event. The trigger can be a changed regulatory policy. And these triggers can be entirely something the firm had not anticipated. Now unlike as in cricket, the reflex of the firm (read the batsman) need not be as sharp as the batsman’s; the only challenge is the firm is definitely not as agile as the batsman nor a single well-coordinated biological entity. However, if the firm can stop being a slob of fat, and be made reasonably agile to exploit the ‘wining space’, it can successfully manage whatever future it comes across.

In all of these illustrations, we see the span is not ‘the fraction of a second’ a batsman has to counter, it is anything from a few hours to a few days at the least. What the firm does now is not proactively determined, it is entirely a reactive frame. And if the firm has invested in enhancing its reactive capabilities, it stands to reap twin benefits. One, it is never paranoid about what future would result, nor does it spend the sky in trying to determine the future scenarios. It need not invest in part-readiness for any of the scenarios, where investment in scenarios which do not occur usually go awaste [say the firm prepared for scenarios A, B, C and D. When scenario C actually happened, the investments stuck towards scenarios A, B and D turn out to be dead meat, though overall learning may have accrued]. Two, the firm can think of competently facing any future scenarios, anticipated or not, prepared for or not. Ideally, such level of reactive capabilities would be a Braham Astra (a legendary asset with infinite powers). True, attaining such level of reactive capabilities that can help the firm meet head on any future, are difficult to attain. So there has to be a judicious mix of being proactive and being reactive, with no overemphasis on either.

So the challenge now is how can the firm equip itself to capitalise the winning space. This can be enabled by a multi-pronged action plan. Firstly, the firm has to tune up its intelligence systems: on business front, on market front, and on within the firm transpirings. The analogy of the batsman sees the bowl has left the bowler’s hand has to be effected. The firm has to know an event has happened which requires its attention. This feed that an event has occurred has to goto the Strategy monitoring, formulation and implementation group of the firm.

This strategy group has to classify the event as to its possible impact. Just like a batsman has pre-thought labelling of a ball as to it being on off-side or on-side, he reads its speed, point of impact, height of impact/ bounce, whether it is a yorker or not, a flipper or not, etc; the firm’s strategy group has to label the event. This can majorly be pre-studied, and to the extent it has to be judgmental, there should be quick communication and information swap channels intra-strategy group. In today’s world, this channel has to be an online conferencing mode. Now strategy formulation is a creative process: so whatever creative time this strategy group thinks it needs and it can afford, let it. Obviously, this strategy group has to have an accurate and real time understanding of the firm’s capabilities and constraints.

Thirdly, the communication lines to the various action groups who would implement the strategy have to be aced up. This not only means insta-speed flow of information, it also means the perception barriers of action teams have been managed in an a priori sense. Just like, the batsman cannot have an unwilling wrist to lift the bat, the firm cannot have action groups who have resistance to implement the strategy.

Fourthly, the action groups have to be endowed in advance, with whatever cross-functional competencies the action teams would need to deploy to execute the strategy. The action team’s real time learning capabilities should match any deficit they may have on needed competencies.

The batsman has no control on the pitch, the weather conditions, the spectators’ reactions, the field setup etc. The firm too has to, in the short-run of the winning space, live with immobility of customer perceptions, competition’s intensity, and macroeconomic realities. The firm also is possibly saddled with slow changing or unchanging technology, unmanoeuvrable capital equipment & infrastructure, suppliers who are not adequately reactive, logistics lags, and usual perception immobility (internal & external). The firm is also bound by its prior commitments. With a target of being effective in its reactive response, the firm has to control its engagements with these immobile facets of business operations.

Man has come so far by being both, reactive and proactive. For many more millennia too, his reactive capabilities shall be needed for survival, growth and development. Ditto for the firm. Looking around, the authors advocate a resurgence of initiatives that make a firm agile and lean, shedding obsessive fixation with being proactive. More so as today’s future is much more complex than that waited for firms a few decades ago, in a way frustrating attempts at mapping it with even reasonable exactitude. Instead of feeling helpless then, the firm must brace up via improving its reactive capabilities. Sure, disruptive or blue ocean strategies of competition would impact the firm powerfully, but then the battle has still t be won. The firm can still win by its tactical and reactive responses.

Authors: Amit Kapoor & Sandeep Mann